Capital Management Company and Fund administration in

Luxembourg

Capital Management Company and Fund administration in Luxembourg

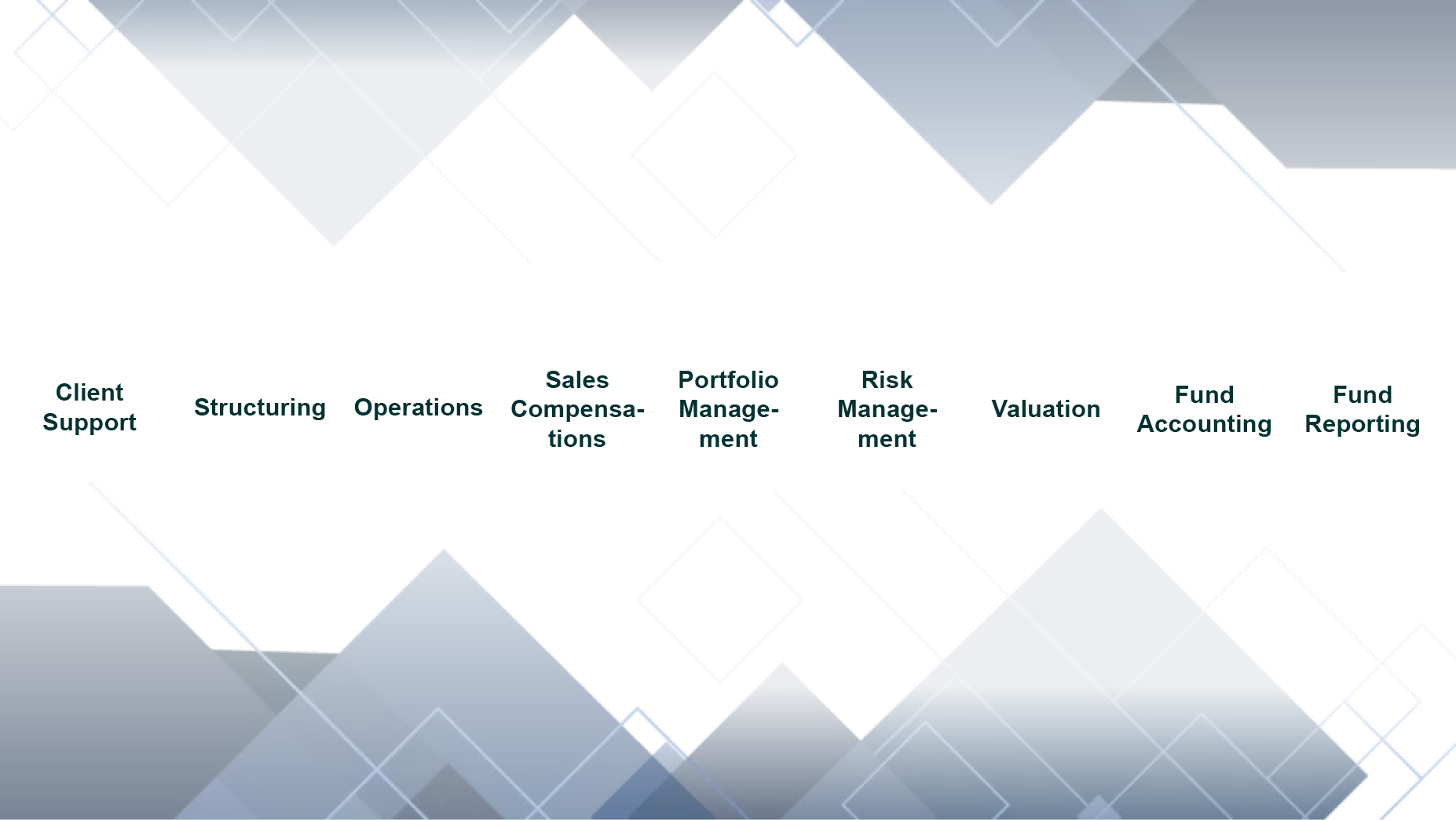

We offer you a comprehensive service, from advice and conception of your product idea to the approval and launch process, portfolio management and fund controlling.

consulting and support through the entire fund cycle

Our services as a Capital Management Company

With Hauck & Aufhäuser Fund Services S.A. in Luxembourg, we offer you a comprehensive service, starting with advice and conception of your product idea, through the approval and launch process, to fund management and fund controlling. You receive all solutions from a single source. We accompany you through the entire value chain, including all steps that are necessary and contribute to the successful performance of your fund.

Structuring

- Advice on the toolbox of our structuring solutions in Luxembourg, Germany and Ireland (UCITS, AIF, ELTIF, etc.)

- Implementation and coordination of the entire launch process for our fund structures and securitization solutions

- Preparation and coordination of all relevant fund documents

- Implementation of the regulatory approval process for regulated products

- Central point of contact for all questions relating to product launch

- Coordination between the partners involved (initiators, law firms, tax advisors, auditors)

- Ongoing monitoring and implementation of regulatory requirements for the products

Operations & Sales Compensation

- Register and transfer agent function (settlement of unit certificate transactions) *

- Cooperation with fund platforms

- Reimbursement of sales commissions received on unit transactions and reporting of reimbursement of sales commissions *

- Processing of sales follow-up commission

- Payment to sales partners

- Plausibility check of portfolio reports for settlement

- Settlement reporting to sales partners and fund initiators

- Monthly reporting of stock reports to the fund initiator

* These tasks have been outsourced to Hauck Aufhäuser Lampe Privatbank AG, Niederlassung Luxemburg.

Portfolio Management

- Independent Risk Management in line with applicable regulatory requirements, i.a. AIFM- and UCITS Directives as well as applicable local requirements, e.g. Luxembourg or Germany

- Operational Risk Management on entity and product level

- Continuous monitoring, support and advise during full fund life cycle

- Implementation and application of adequate risk framework, covering at least the required risk categories and considering fund specificities such as e.g. fund structure, strategy, asset class

- Setup and monitoring of fund specific risk profiles including quantitative and qualitative risk metrics and corresponding limits, where required and applicable

- Stress- and backtesting

- Post-trade investment compliance monitoring incl. e.g. leverage or SFDR related disclosures/ investment restrictions

- Assessment of asset valuation methods and procedures

- On-going, periodic or ad-hoc risk reporting

- Active role and dedicated involvement within the overall outsourcing/ delegation oversight framework

Risk Management

- Independent risk management in accordance with applicable regulatory requirements, including AIFM and UCITS guidelines and applicable local requirements, e.g. in Luxembourg or Germany

- Operational risk management at company and product level

- Continuous risk monitoring, support and advice throughout the entire life cycle of a fund

- Implementation and application of an adequate risk framework that covers at least the required risk categories and takes into account fund specifics such as fund structure, strategy or asset class

- Preparation and monitoring of fund-specific risk profiles, including quantitative and qualitative risk metrics and corresponding limits, where necessary and applicable

- Stress and backtesting

- Monitoring compliance with investment regulations, including in relation to leverage or SFDR

- Review of methods and procedures relating to the valuation of assets

- Ongoing, periodic or ad-hoc risk reporting

- Active role and targeted input within the outsourcing/delegation oversight framework

Valuation

- Implementation of an internal valuation function which is independent from the portfolio management function and in compliance with AIFMD requirements

- Establishment and application of the policies and procedures as well as valuation models for the valuation of assets in AIFs according to AIFMD

- Involvement of investment advisors

- Regular reporting to the management board of AIF and to the board of AIFM

- Implementation of a clear and structured resolution process to address valuation- related queries or deviations from established valuation guidelines, ensuring swift and effective resolution.

Fund Accounting

- Full preparation and control of the net asset value (NAV) calculation.

- Calculation and publication of the daily tax ratios

- Control and provision of the valuation rates

- Reconciliation of the portfolio in cooperation with the custodian bank

- Support for regulatory reporting in the respective distribution countries

- Preparation and reconciliation of the accountability reports

Fund Reporting

- Access to the HAL Investment Portal Luxembourg

- Customized presentation materials for investment committee meetings

- Provision of a comprehensive Net Asset Value (NAV)fund reporting

- Preparation of Fund Factsheets

- Fund price publication in the media of your choice

- Individual reporting requests